The Importance of RBI’s Monetary Policy in Managing India’s Economy

As the Indian economy continues to grow and evolve, the Reserve Bank of India’s (RBI) monetary policy plays a crucial role in keeping it steady. With inflation rates, interest rates, and exchange rates constantly fluctuating, the RBI’s decisions on how much money should be circulating in the economy can have far-reaching consequences.

In this blog post, we’ll dive into why understanding and monitoring the RBI’s monetary policy is so important for anyone interested in India’s economic growth and stability. Whether you’re an investor or simply curious about how your country manages its finances, read on to discover just how critical this aspect of fiscal management really is.

Introduction to RBI’s Monetary Policy

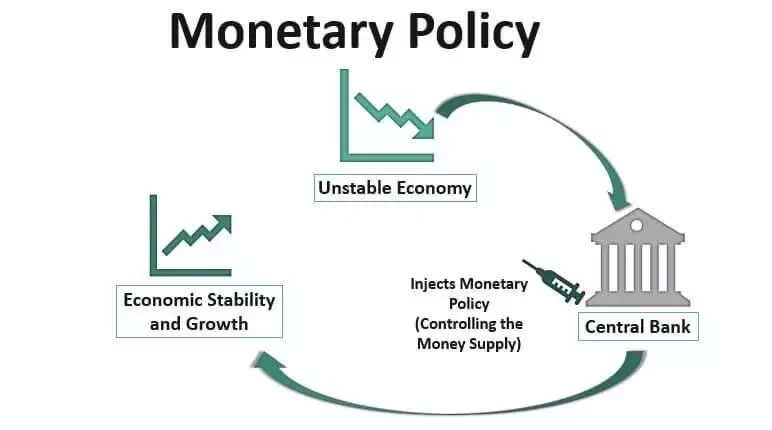

The Reserve Bank of India’s (RBI) monetary policy is one of the most important tools in managing India’s economy. The RBI uses monetary policy to influence the supply of money in the economy and thus, inflation. By controlling the money supply, the RBI can keep inflation in check, which is essential for sustaining economic growth.

The RBI sets interest rates through its monetary policy actions. When interest rates are high, it becomes more expensive for businesses to borrow money, which can slow down economic growth. On the other hand, when interest rates are low, businesses can borrow money more cheaply and invest in expansion, leading to economic growth.

The RBI also uses its monetary policy to manage liquidity in the banking system. Liquidity refers to the ability of banks to meet customer demand for withdrawals and loan repayments. If there is not enough liquidity in the system, banks may be unable to meet customer demands, leading to a financial crisis. By managing liquidity through its monetary policy actions, the RBI can help avoid such crises.

Thus, RBI’s monetary policy plays a vital role in ensuring macroeconomic stability and sustaining economic growth in India.

What are the Key Features of RBI’s Monetary Policy?

The Reserve Bank of India’s (RBI) monetary policy is a set of measures used to regulate the money supply in the economy. The main objectives of RBI’s monetary policy are to maintain price stability, promote economic growth, and ensure financial stability.

RBI uses a number of tools to achieve these objectives, including:

- Setting interest rates: RBI sets the benchmark interest rate at which banks can borrow money from it. This rate is known as the repo rate. By changing the repo rate, RBI can influence the cost of borrowing for banks, which in turn affects lending rates and the availability of credit in the economy.

- Open market operations: Through open market operations, RBI buys or sells government securities in order to manage the money supply in the economy.

- Reserve requirements: RBI sets reserve requirements for banks, which dictate how much cash they must keep on hand. By changing these requirements, RBI can influence the amount of credit that banks can extend to borrowers.

- Credit controls: RBI can also use credit controls to influence lending and credit availability in the economy. These controls limit the types of loans that banks can extend and impose restrictions on lending rates.

How Does the RBI’s Monetary Policy Impact India’s Economy?

The Reserve Bank of India’s (RBI) monetary policy has a direct impact on the Indian economy through its effect on inflation, output and interest rates. By controlling the money supply and setting interest rates, the RBI can influence inflation and economic growth.

Inflation is one of the most important factors that the RBI takes into account when formulating monetary policy. By keeping inflation under control, the RBI can help maintain economic stability.

When inflation is high, it erodes the purchasing power of consumers and leads to higher production costs for businesses. This can eventually lead to slower economic growth. On the other hand, if inflation is too low, it can lead to deflationary pressure and slow down economic activity.

The RBI uses a variety of tools to influence inflation and economic growth. These include changes in reserve requirements, open market operations and changes in interest rates. By changing these parameters, the RBI can encourage or discourage lending by banks and other financial institutions. This in turn affects the money supply in the economy and ultimately influences inflation and output.

The RBI’s monetary policy has a significant impact on India’s economy. By controlling the money supply and setting interest rates, the RBI can help keep inflation under control and encourage economic growth.

What Are the Benefits of Having a Strong Monetary Policy in India?

There are many benefits of having a strong monetary policy in India. One of the most important benefits is that it can help to keep inflation under control. This is important because high inflation can lead to economic problems such as higher interest rates and a decrease in purchasing power.

Additionally, a strong monetary policy can help to promote economic growth by encouraging investment and lending. Finally, a sound monetary policy can help to build confidence in the economy and financial markets.

A strong monetary policy can also help to promote financial stability by providing the necessary tools to maintain the value of the Indian rupee.

This is important for both domestic and international trade since it helps to ensure that prices remain stable and predictable. Finally, a well-defined monetary policy can provide clarity and predictability which could lead to increased foreign investment in India’s economy.

Challenges Faced by RBI in Implementing its Monetary Policy in India

The Reserve Bank of India (RBI) is the central bank of India and it is responsible for managing the country’s monetary policy. The RBI implements its monetary policy through a number of tools, including setting interest rates, changing reserve requirements, and engaging in open market operations.

The RBI has faced a number of challenges in recent years in implementing its monetary policy. First, the RBI has had to contend with high inflationary pressure in the economy. In order to keep inflation under control, the RBI has been forced to raise interest rates, which has made it difficult for businesses to obtain financing and invest.

Second, the RBI has also been dealing with a weakening rupee. The depreciation of the rupee makes imported goods more expensive and raises the cost of borrowing for Indian companies. As a result, the RBI has had to take measures to support the rupee, such as selling foreign currency reserves and intervention in the foreign exchange market.

Third, another challenge facing the RBI is bad loans in the banking sector. Non-performing assets (NPAs) have risen sharply in recent years, reaching Rs 8.5 trillion (US$ 130 billion) by March 2018. This has put strain on banks’ balance sheets and hampered their ability to lend money and support economic growth. The RBI has been working with banks to resolve this issue through asset quality reviews and other measures.

Conclusion

In conclusion, RBI’s monetary policy plays a crucial role in managing India’s economy. It is an essential tool for controlling inflation and keeping economic growth on track. The RBI uses various instruments to keep the money supply in check and ensure that prices remain stable. By adjusting interest rates, setting credit limits and issuing open market operations, RBI has been able to maintain macroeconomic stability over the years. Through its various measures, it ensures that India’s economy remains healthy and growing at a steady rate.