Making Your Money Grow: How to Choose the Right Mutual Funds for Long-Term Investments

Are you ready to turn your hard-earned money into a long-term investment? Mutual funds are an excellent option for those who want to grow their wealth without spending hours researching individual stocks.

But with so many mutual funds available, how do you choose the right one for your financial goals? In this blog post, we’ll share some tips and tricks on selecting the best mutual fund for long-term investments. So sit back, grab a cup of coffee, and let’s get started on making your money grow!

What Are Mutual Funds?

Investing in mutual funds is one of the smartest things you can do to secure your financial future. But with so many different types of mutual funds available, how do you know which ones are right for you?

Here’s a quick rundown on what mutual funds are and how they work:

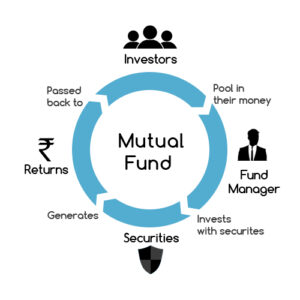

A mutual fund is an investment vehicle that pools money from many investors and invests it in a portfolio of securities, such as stocks, bonds, or short-term debt. The advantage of investing in a mutual fund is that it gives you access to a professionally managed portfolio of investments that would be difficult and costly to replicate on your own.

When you invest in a mutual fund, you become a shareholder of the fund. The value of your shares will go up or down depending on the performance of the underlying securities in the fund’s portfolio.

Most mutual funds are “open-ended,” which means that they issue new shares to investors as demand increases and redeem shares when investors want to cash out. This allows the fund to maintain a constant share price.

There are two main types of mutual funds: equity funds and fixed-income funds. Equity funds invest in stocks and aim to provide capital growth over time. Fixed-income funds invest in bonds and aim to provide income and stability. There are also hybrid funds that invest in both stocks and bonds.

Determining Your Mutual funds Investment Goals

When it comes to investing, there is no one-size-fits-all approach. The best way to grow your money is to first determine your investment goals. Are you looking to save for retirement? Build up an emergency fund? Or are you aiming to generate income from your investments?

Once you know your goals, you can start researching different types of mutual funds that can help you reach them. For example, if you’re saving for retirement, you may want to consider investing in a target date fund. This type of fund automatically rebalances itself as you get closer to retirement, becoming more conservative as the target date approaches.

If you’re looking for immediate income, meanwhile, dividend paying funds may be a good option. These funds invest in stocks that pay regular dividends, providing you with a stream of income that you can reinvest or use to cover expenses.

Finally, if you’re aiming for long-term growth, index funds or actively managed funds may be the right choice for you. Index funds track a specific market benchmark, such as the S&P 500, and offer low fees and broad diversification.

Actively managed funds are run by professional investors who aim to outperform the market benchmarks. However, these funds typically come with higher fees than index funds.

No matter what your investment goals are, there’s a mutual fund out there that can help you reach them. By doing some research and knowing what you’re looking for, you can invest in right funds.

Types of Mutual Funds

There are four main types of mutual funds: stock, bond, money market, and balanced.

Stock mutual funds invest in stocks and are the riskiest but also have the potential for the highest returns. Bond mutual funds invest in bonds and are less risky but also have lower returns. Money market mutual funds invest in short-term debt and are even less risky but also have even lower returns. Balanced mutual funds invest in a mix of stocks and bonds and are somewhere in between in terms of risk and return potential.

Which type of mutual fund is right for you will depend on your investment goals and your tolerance for risk. If you’re investing for the long term, you can afford to take more risks since you have time to ride out the ups and downs of the market. If you’re investing for a shorter timeframe or if you need your money sooner, you’ll want to stick with less risky investments.

How to Choose the Right Mutual Fund for You

If you’re looking to invest in mutual funds, there are a few things you’ll need to consider before choosing which ones are right for you. First, you’ll need to decide what your investment goals are. Are you looking to grow your money over the long term, or are you more interested in short-term gains?

Once you know what your goals are, you can start researching different mutual funds. There are thousands of mutual funds to choose from, so it’s important to narrow down your options. Start by looking at the fund’s performance history and expense ratio. You should also read the fund’s prospectus to get a better understanding of how it invests its assets.

Finally, don’t forget to consider your own risk tolerance when choosing a mutual fund. If you’re not comfortable with volatile investments, then a more conservative fund may be a better choice for you. By doing your research and knowing your goals, you can find the right mutual fund for you and start growing your money.

Tips for Investing in Mutual Funds

When it comes to investing in mutual funds, there are a few things you should keep in mind in order to make sure you’re making the right choice for your long-term goals. Here are a few tips to help you out:

1. Know Your Investment Goals

Before investing in any mutual fund, you need to know what your investment goals are. What are you looking to achieve with your investment? Are you trying to grow your wealth over time or generate income from your investments? Once you know your goals, you can narrow down your choices and find the right mutual fund for you.

2. Consider the Fees

Mutual funds come with various fees, such as management fees and expense ratios. These fees can eat into your returns, so it’s important to consider them when choosing a fund. Look for low-cost funds that will save you money in the long run.

3. Review the Fund’s Performance History

When evaluating a mutual fund, be sure to look at its performance history. This will give you an idea of how the fund has performed in the past and can help you predict its future performance. However, don’t put too much emphasis on short-term performance; instead, focus on the long-term track record of the fund.

Tax Advantages of Investing in Mutual Funds

When it comes to taxes, mutual funds offer some significant advantages. First, the capital gains from mutual fund investments are taxed at a lower rate than other types of investments. Second, you can defer taxes on your mutual fund investments by investing in a tax-deferred account such as a 401(k) or IRA. Finally, you can avoid taxes altogether on your mutual fund dividends by reinvesting them back into the fund.

Advantages and Disadvantages of Investing in Mutual Funds

When it comes to investing, there are a lot of different options to choose from. One option that you may be considering is investing in mutual funds. Mutual funds are a popular investment choice for many people because they offer a number of advantages, including professional management, diversification, and economies of scale.

However, there are also some potential disadvantages to investing in mutual funds that you should be aware of before making any decisions. Some of the potential drawbacks include high fees, lack of transparency, and limited control over your investment.

Before making any decisions about investing in mutual funds, it’s important to weigh the pros and cons carefully to see if they’re right for you.

Conclusion

Investing in mutual funds is a great way to grow your money over time. With the right research and knowledge, you can make smart decisions about which funds are best for your long-term objectives. Remember to diversify across multiple asset classes and maintain an appropriate level of risk for your needs.

Be sure to check out each fund before making any investment decisions, so that you know exactly what kind of performance you can expect from them. Taking the time to do this now will help ensure that your investments pay off in the future!