What is an Index in the Stock Market?

Are you curious about the stock market and how it works? If there’s one term that you should know, it’s “index.” In this blog post, we’ll explore what an index in the stock market is and why it matters to investors. Whether you’re a seasoned trader or just starting out in the world of stocks, understanding indices will help you make more informed investment decisions. So let’s dive in and discover everything there is to know about stock market indices!

I. What is an Index in the Stock Market?

An index is a tool used by investors to measure the performance of a particular market or sector. In the Indian stock market, there are several different indices that track different aspects of the market. The most well-known index in the stock market is the Sensex, which tracks the performance of the 30 largest companies listed on the Bombay Stock Exchange.

Other popular indices include the Nifty 50, which tracks the performance of the 50 largest companies listed on the National Stock Exchange, and the BSE 100, which tracks the performance of the 100 largest companies listed on the Bombay Stock Exchange.

Indices are often used by investors as a benchmark to compare the performance of their portfolio to the overall market. For example, if an investor’s portfolio goes up by 10% while the Sensex goes up by 15%, then the investor can be said to have outperformed the market. Similarly, if an investor’s portfolio goes down by 10% while the Sensex goes down by 5%, then the investor can be said to have underperformed the market.

Many investors use index funds as a way to invest in a particular market or sector without having to pick individual stocks. Index funds are mutual funds or exchange-traded funds that track a specific index. For example, there are index funds that track the Sensex, Nifty 50, and BSE 100.

Investing in an index fund is a passive investment strategy, as opposed to active investing, where an investor buys and sells individual stocks in

II. How is an Index Calculated?

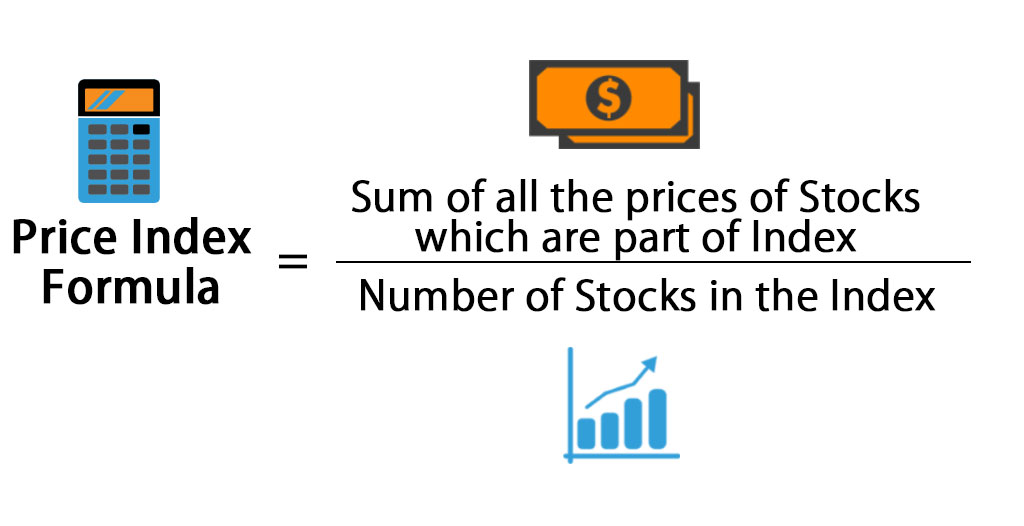

The calculation of an index in the stock market is done by taking the average of the price movements of the stocks that are part of the index. This is done by taking the sum of the price movements of the stocks and dividing it by the number of stocks in the index. This gives a weighted average of the price changes of the stocks in the index. The index is then expressed as a percentage change from the base value (which is usually the starting value of the index, though it can also be set to a different value). This percentage change can then be used to gauge the performance of the index.

III. Benefits of Using an Index

An index is a tool that can be used to measure the performance of a group of stocks. It can be used as a benchmark to compare the performance of individual stocks.

There are many benefits of using an index in the stock market, including:

1. It can provide a broad overview of the market: By looking at an index, you can get a quick snapshot of how the stock market is performing as a whole. This can be helpful in making investment decisions.

2. It can be used to track specific sectors: An index can be used to track the performance of specific sectors within the stock market. This information can be helpful in making sector-specific investment decisions.

3. It can be used to measure risk: An index can be used to measure the level of risk in the stock market. This information can be helpful in determining an appropriate level of risk for your portfolio.

4. It can be used to find new opportunities: An index can be used to identify new investment opportunities. This information can be helpful in finding stocks that are undervalued by the market.

IV. Types of Indices

There are three main types of indices in the Indian stock market: the Bombay Stock Exchange (BSE) Sensitive Index (Sensex), the National Stock Exchange (NSE) Nifty 50, and the S&P BSE 500.

The Sensex is the oldest and best-known index in India, having been launched in 1986. The index consists of 30 of the largest and most actively traded stocks on the BSE.

The Nifty 50 is a more recent index, having been launched in 1996. As its name suggests, it consists of 50 stocks from across a range of sectors. The Nifty 50 is widely considered to be a better gauge of the Indian stock market than the Sensex, as it is less influenced by large individual stocks.

The S&P BSE 500 is an index of 500 stocks that are traded on the BSE. The index covers a wide range of companies from different sectors, making it a good representation of the overall stock market.

V. Conclusion

An index is an important measure of the performance of the stock market, which can help investors make informed decisions when trading. There are different types of indices that can be used, each tracking different stocks and calculated differently. By understanding how an index works and the benefits of using it, investors can get valuable insights into the performance of the stock market.