Decoding Warren Buffett’s Investment Strategy for Wealth Creation | Expert Insights 2024

Warren Buffett, widely regarded as one of the most successful investors of all time, has built his fortune by adhering to a set of time-tested investment principles. His approach to investing is rooted in a combination of value investing, fundamental analysis, and a long-term perspective. Studying Warren Buffett’s investment strategy reveals invaluable insights into successful long-term wealth accumulation.

Key facts about Warren Buffett

- Buffett bought his first stock at age 11 after he said he’d read every book on investing in the Omaha library, some of them twice.

- Buffett studied at the University of Pennsylvania, University of Nebraska and Columbia Business School. It was at Columbia where he met his mentor Benjamin Graham, who many consider the “father of value investing.”

- Buffett ran an investment partnership from 1957-1969, generating annual returns of 23.8 percent after fees, according to Fortune magazine.

- Buffett took control of Berkshire Hathaway on May 10, 1965 and the stock closed at $18 per share. It now trades at about $543,000 per Class A share.

- Berkshire Hathaway’s insurance float has grown from $19 million in 1967 to $164 billion in 2022, according to Buffett’s 2023 letter to Berkshire shareholders.

- Buffett purchased a $1.3 billion stake in Coca-Cola in the late 1980s because of its strong brand and global growth prospects. The stake is worth about $22 billion.

- Buffett is famous for his unhealthy diet, often consuming several Cherry Cokes a day and preferring steak or hamburgers with potatoes to any sort of vegetables.

- In 2006, Buffett committed to giving away more than 99 percent of his wealth to charitable foundations, much of it to the Bill & Melinda Gates Foundation.

- Since Buffett took control of Berkshire Hathaway in 1965, the stock has compounded at an annual rate of 19.8 percent through 2022, compared to 9.9 percent for the S&P 500, according to Buffett’s 2023 letter to shareholders.

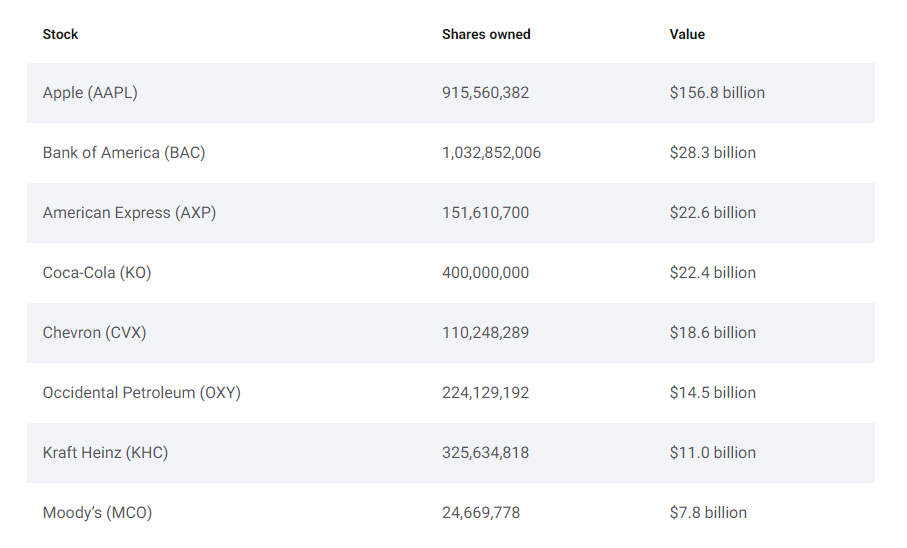

Warren Buffett’s & Berkshire Hathaway’s top Investments

Decoding Warren Buffett’s Investment Strategy:

-

Value Investing: The Bedrock of Buffett’s Success

At the heart of Buffett’s investment philosophy is the concept of value investing. He seeks to identify companies that are undervalued in the market, often overlooked by other investors. This involves a meticulous analysis of a company’s financial statements, earnings reports, and overall economic moat.

Buffett often emphasizes the importance of a company having a durable competitive advantage, or economic moat. This could be in the form of strong brand recognition, cost advantages, regulatory advantages, or any factor that makes it difficult for competitors to erode a company’s profitability over time.

Warren Buffett has demonstrated his mastery of value investing through his consistent track record of successful investments over several decades. His strategy has proven effective not only during periods of economic prosperity but also during times of crisis when he was able to capitalize on opportunities amidst market turmoil.

-

Long-Term Perspective: The Power of Patience

One of Buffett’s most famous quotes is, “Our favorite holding period is forever.” Unlike many investors who succumb to short-term market fluctuations, Buffett is known for his unwavering commitment to holding onto investments for the long haul. This approach allows him to benefit from the power of compounding and ride out market volatility.

Buffett’s buy-and-hold strategy involves carefully selecting companies with strong fundamentals and holding onto them for an extended period. This patient approach not only minimizes transaction costs but also aligns with his belief that quality investments will appreciate over time.

The power of patience is a key aspect of Warren Buffett’s investment philosophy. He believes that good companies with strong fundamentals will continue to grow and generate wealth over time. This means that he does not get swayed by short-term market fluctuations or news events, but instead focuses on the long-term potential of a company.

One example of this is Buffett’s investment in Coca-Cola. He first bought shares in the company back in 1988 and has held onto them ever since. Despite facing some challenges along the way, such as changing consumer preferences towards healthier options, Buffett remained patient and confident in Coca-Cola’s brand strength and global presence. As a result, his initial investment has grown significantly over the years.

-

Focus on Quality Companies:

Warren Buffett is famous for his long-term investment approach, where he focuses on quality companies rather than chasing short-term gains. This strategy has served him well in the past and continues to be a key factor in his success as an investor.

So, what exactly does it mean to focus on quality companies? In simple terms, it means investing in businesses that have strong fundamentals and a sustainable competitive advantage. These are companies that have a proven track record of profitability, efficient management, and a strong brand reputation.

One of the main advantages of focusing on quality companies is the potential for long-term growth and stability. By carefully selecting companies with solid financials and a strong market position, investors can mitigate risks and increase their chances of earning consistent returns over time. This aligns with Buffett’s famous saying: “It’s far better to buy a wonderful company at a fair price than to buy a fair company at a wonderful price.”

Buffett has stated that he looks for businesses with “economic moats,” which refer to sustainable competitive advantages that protect them from competitors. These could include patents, strong customer relationships, or high barriers to entry in their industry. Companies with these characteristics are more likely to maintain their profits even during economic downturns.

-

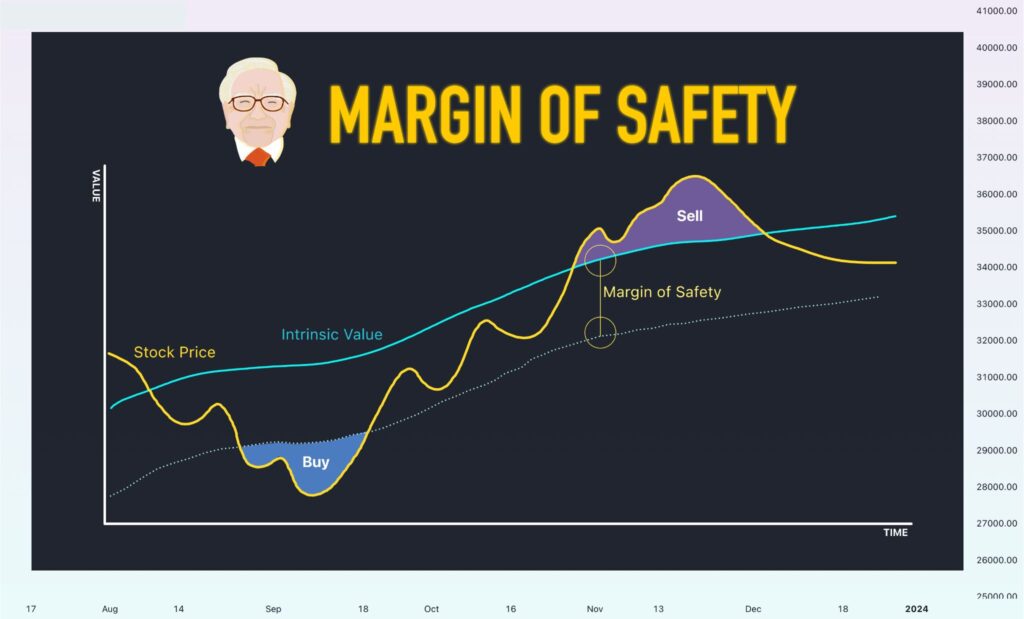

Margin of Safety: Protecting Investments from Downside Risk

Buffett is a proponent of the margin of safety concept, which involves buying a stock at a price significantly below its intrinsic value. This provides a buffer against unforeseen events and market downturns, reducing the risk of permanent capital loss.

By adhering to this principle, Buffett protects his investments from potential downside risk. He understands that every investment carries some level of risk, and it is essential to have a cushion against potential losses. The margin of safety acts as this cushion and helps investors weather any unfavorable market conditions.

So how exactly does one determine the margin of safety for an investment? It starts with analyzing the company’s financials and understanding its true worth. Buffett looks at various factors such as earnings growth, cash flow, debt levels, and competitive advantage to assess a company’s intrinsic value. Once he determines this value, he then compares it to the current market price.

For example, if Company X has an intrinsic value of Rs. 100 per share but is currently trading at Rs. 80 per share in the stock market, there is a 20% margin of safety for investors. This means that even if the stock were to decline by 20%, investors would still break even on their investment. As such, by purchasing stocks below their intrinsic value or with an adequate margin of safety, investors can protect themselves against potential losses.

-

Continuous Learning and Adaptation

Despite his decades of success, Buffett is a voracious learner who adapts his strategies based on changing market conditions. He stays informed about macroeconomic trends, industry developments, and technological advancements that may impact his investments.

Continuous learning and adaptation are key elements of Warren Buffett’s investment strategies. The renowned billionaire investor has always emphasized the importance of constantly seeking knowledge and adapting to changes in the market.

Buffett believes that successful investing requires a deep understanding of the companies one is investing in. This means staying updated on industry trends, analyzing financial reports, and keeping an eye on market news and events. For Buffett, learning is a never-ending process, and he spends several hours each day reading books, newspapers, and company reports to expand his knowledge.

In addition to continuous learning, adaptation is crucial for long-term success in the investment world. Buffett famously said, “If you’re not willing to adapt, you’ll get left behind.” As markets evolve and industries change, it’s essential for investors to be open-minded and adaptable to new strategies.

Continuous learning and adaptation have been integral components of Warren Buffett’s investment strategies throughout his successful career. By continuously expanding his knowledge, embracing change, and remaining patient and open-minded, Buffett has been able to achieve consistent returns for his investors. Aspiring investors can learn valuable lessons from this approach and incorporate it into their investment strategies for long-term success in the dynamic world of investing.

Conclusion:

Warren Buffett’s investment strategies are a blueprint for long-term success in the world of finance. By focusing on value, maintaining a patient approach, emphasizing quality, seeking a margin of safety, and continuously learning, investors can apply these principles to navigate the complexities of the market. While no strategy guarantees success, understanding and incorporating these principles can certainly enhance one’s chances of building lasting wealth.